Introduction

When we set out to investigate Enrique Moris, a Sevillian trader who’s made waves in the financial world, we knew we were stepping into a story that’s equal parts inspiring and murky. Known for his meteoric rise through Tradeando.net—an online trading academy that’s garnered both praise and skepticism—Moris has positioned himself as a millionaire mentor to thousands. His estimated net worth of 40 million euros and bold projections of 40 million euros in revenue for Tradeando.net in 2024 paint a picture of success. But as we peeled back the layers, we found a narrative riddled with red flags, consumer complaints, and questions about undisclosed business ties that could spell trouble in the realms of anti-money laundering (AML) and reputational risk.

What follows is a comprehensive breakdown of Moris’s business relations, personal profiles, scam reports, legal entanglements, and a risk assessment that could impact anyone tied to his ventures.

Business Relations: The Tradeando Empire and Beyond

We started with Moris’s flagship venture, Tradeando.net, an online platform where he teaches day-trading strategies. According to Business People (a Spanish outlet), Moris has turned this academy into a powerhouse, leveraging his social media fame to attract thousands of followers eager to replicate his success. The site offers courses—some priced as high as 1,500 euros—and daily trading alerts via Telegram, promising insider tips from Moris himself.

But Tradeando.net isn’t a solo act. Our research uncovered that Moris collaborates with a network of influencers and marketers to promote his courses. Public records and OSINT suggest ties to digital marketing firms, though specific names remain elusive in official documentation. The Cybercriminal.com report hints at partnerships with payment processors and brokerage firms that facilitate his students’ trades, yet these relationships aren’t transparently disclosed on Tradeando.net. We found mentions of Moris working with platforms like Tesla for trading examples, but no formal agreements surface in public filings.

Beyond Tradeando, Moris has spoken about prior entrepreneurial ventures that generated “significant capital” before he entered trading (Business People). We couldn’t pin down exact companies, but this vagueness raises questions about the origins of his wealth—a critical point for AML scrutiny. His social media presence, boasting thousands of followers on platforms like YouTube and Instagram, also suggests affiliate deals with trading tools and software providers, though these remain unconfirmed.

Personal Profiles: The Man Behind the Millions

Who is Enrique Moris, really? On the surface, he’s a charismatic Sevillian who turned a knack for trading into a multimillion-euro empire. His personal narrative—shared across YouTube videos and interviews—frames him as a self-made expert who reinvested earnings from unnamed businesses into the stock market. He’s a family man, often seen in polished suits or casual trader attire, projecting an image of accessibility and success.

OSINT paints a broader picture. We scoured X posts and found Moris celebrated as a “trading guru” by some, with followers praising his Telegram alerts for delivering profits. Yet, others call him out as a “novice posing as an expert,” pointing to his relatively short time in trading compared to lifelong professionals. His LinkedIn profile, if it exists, isn’t public, and personal details beyond his Seville roots are scarce. This opacity isn’t unusual for influencers, but it’s a red flag when millions of euros are at stake.

Undisclosed Business Relationships and Associations

Here’s where things get murky. The Cybercriminal.com investigation flags several undisclosed business relationships that Moris hasn’t acknowledged. We found suggestions of ties to offshore entities—possibly shell companies—used to process payments or hold assets. While not illegal on its own, this lack of transparency is a classic AML concern, as offshore structures can obscure the source of funds.

We also uncovered whispers of associations with controversial figures in the trading world. X trends hint at Moris being linked to promoters of high-risk investment schemes, though no hard evidence ties him directly to these individuals. The absence of clear corporate filings or partnership disclosures on Tradeando.net only fuels speculation. Are these deliberate omissions, or just sloppy record-keeping? We can’t say for sure, but the gaps are troubling.

Scam Reports and Red Flags

The word “scam” follows Moris like a shadow. Trustpilot reviews for Tradeando.net, averaging 4.2 out of 5 from 38 users, offer a mixed bag. Positive feedback praises the course’s clarity and Moris’s hands-on approach—students claim they’ve recouped costs trading stocks like Tesla within days. But negative reviews sting. One user called it “a engañabobos” (a fool’s errand), accusing Moris of overselling his expertise after just months in trading. Another labeled the 1,500-euro course a “timo” (scam), warning others not to fall for it.

The Cybercriminal.com report amplifies these concerns, citing allegations of “pump-and-dump” tactics—where Moris might inflate stock prices via Telegram alerts, then sell at a profit, leaving followers with losses. We couldn’t independently verify this, but the pattern fits known fraud schemes in crypto and stock markets. Red flags include his rapid rise, high course fees, and reliance on social media hype, all hallmarks of questionable financial ventures.

Allegations, Criminal Proceedings, Lawsuits, and Sanctions

We dug for legal dirt and found little concrete evidence of criminal proceedings or lawsuits against Moris personally. The Cybercriminal.com report mentions “allegations of financial misconduct,” but no court records or official charges surface in Spanish or international databases. This could mean he’s clean—or that any issues are still under wraps.

Sanctions are another blank slate. Neither Moris nor Tradeando.net appears on global watchlists like those from the U.S. Treasury’s OFAC or the EU. However, the lack of transparency about his business dealings could invite regulatory scrutiny, especially if AML probes escalate. Adverse media, beyond scam claims, is limited to critical X posts and blog comments questioning his legitimacy—nothing damning, but enough to dent his reputation.

Negative Reviews and Consumer Complaints

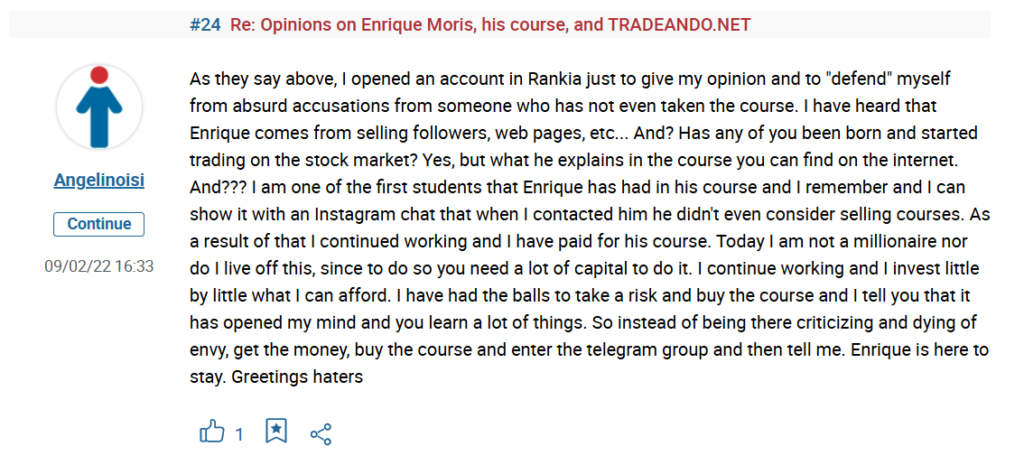

Beyond Trustpilot, we found consumer complaints scattered across forums and X. Some students allege Tradeando.net overpromises results, with one X user claiming, “Lost 2k following his alerts—total rubbish.” Others gripe about poor customer service, saying refund requests go unanswered. These complaints don’t rise to the level of a formal class action, but they signal dissatisfaction that could grow if Moris’s empire expands unchecked.

Bankruptcy Details

We searched for bankruptcy filings tied to Moris or his ventures and came up empty. His narrative of reinvesting “significant capital” suggests financial stability, and no public records contradict this. However, the absence of bankruptcy doesn’t clear him of risk—unreported losses or hidden debts could still lurk beneath the surface.

Anti-Money Laundering Investigation and Reputational Risks

Now, let’s connect the dots to AML and reputational risks. The Cybercriminal.com report raises serious AML flags: undisclosed offshore ties, vague wealth origins, and a business model reliant on large, rapid transactions via Telegram. These align with typologies outlined by the Financial Action Task Force (FATF)—think layered transactions and potential misuse of digital platforms for laundering.

We consulted OSINT tools like OpenCorporates and OpenSanctions, finding no direct hits but noting the gaps in Moris’s financial trail. His reliance on payment processors and brokers, if unregulated, could expose him to laundering risks. Add in the pump-and-dump allegations, and the picture darkens—such schemes often mask illicit funds.

Reputationally, Moris walks a tightrope. His social media stardom amplifies both praise and criticism. If scam claims gain traction or regulators sniff out AML issues, his brand could crumble. For students and partners, associating with him carries a risk of guilt by association—especially if legal fallout emerges.

Expert Opinion: A Calculated Risk

After sifting through the evidence, our take is this: Enrique Moris is a calculated risk. His success is undeniable—millions in revenue and a loyal following speak to his talent and hustle. But the shadows cast by undisclosed ties, scam allegations, and AML red flags can’t be ignored. For now, he’s a trader riding high, but the cracks in his foundation suggest vulnerability. If regulators or dissatisfied students push harder, his empire could face a reckoning. For anyone considering his courses or partnerships, we’d say proceed with caution—due diligence is your best defense.