In the rapidly evolving world of cryptocurrency and blockchain technology, new ventures frequently emerge, promising innovative solutions and lucrative investment opportunities. However, not all that glitters is gold. One such entity, Alyx Union, has recently come under intense scrutiny for allegedly engaging in deceptive practices, including fraudulent copyright takedown notices, impersonation, and operating a Ponzi scheme. This article delves into the intricate details of Alyx Union’s operations, shedding light on the alarming red flags that potential investors and the public should be aware of.

The Emergence of Alyx Union

Established in late 2023, Alyx Union positioned itself as a pioneering force in the cryptocurrency and blockchain sector. The organization claimed to offer innovative investment opportunities, attracting individuals eager to capitalize on the burgeoning digital currency market. However, beneath its glossy exterior, a series of troubling allegations began to surface, casting doubt on the legitimacy of its operations.

Despite its promises of high returns, Alyx Union’s business model exhibited the classic traits of fraudulent schemes. Investors were lured in with the promise of substantial daily profits, only to later discover that the entire operation was built on shaky foundations. The lack of regulatory oversight, combined with the anonymity of its leadership, made it difficult for investors to hold the organization accountable.

Opaque Leadership and Fabricated Executive Representation

A fundamental pillar of any legitimate organization is transparency, particularly concerning its leadership. Alyx Union’s official channels conspicuously lack information about its ownership and executive team. Investigations have revealed that the purported CEO, “Ryan Stasser,” is a fictitious persona. This character was portrayed by an individual linked to a Shenzhen-based charity, suggesting that the executive figurehead is merely a facade. Such deceptive representation raises significant concerns about the organization’s authenticity and governance.

Further digging into the company’s executive structure uncovered a network of shell corporations designed to obscure the true beneficiaries of Alyx Union’s operations. This kind of obfuscation is commonly seen in fraudulent enterprises aiming to avoid legal consequences while continuing to siphon funds from unsuspecting investors.

Ponzi Scheme Operations

Analyses of Alyx Union’s business model indicate characteristics typical of a Ponzi scheme. The company solicited investments in cryptocurrencies, promising daily returns ranging from 0.3% to 1.3%, depending on the lock-up period. These returns were purportedly paid in an obscure cryptocurrency called aelf (ELF). The structure relied heavily on the continuous recruitment of new investors to provide returns to earlier investors, a hallmark of Ponzi operations.

Similar schemes in the past have led to disastrous consequences for investors, with many losing their life savings. Alyx Union’s tactics mirror those of infamous cryptocurrency scams such as BitConnect and OneCoin, which defrauded investors of billions of dollars before their inevitable collapse. As history has shown, Ponzi schemes are unsustainable, and the ones who ultimately suffer are the investors left holding worthless digital assets.

Staged Events and Misleading Marketing

In December 2023, Alyx Union hosted a “year-end celebration event” in Hong Kong. The event featured individuals posing as company executives, including the fictitious “Ryan Stasser.” The use of actors to represent leadership positions is a deceptive tactic aimed at creating a false sense of legitimacy and trustworthiness among potential investors.

Alyx Union also engaged in aggressive social media campaigns, enlisting influencers and paid testimonials to promote its platform. These marketing strategies painted a picture of rapid success and financial security, convincing more individuals to invest their hard-earned money. However, as with many scams, these promotions were carefully orchestrated to hide the reality of Alyx Union’s fraudulent activities.

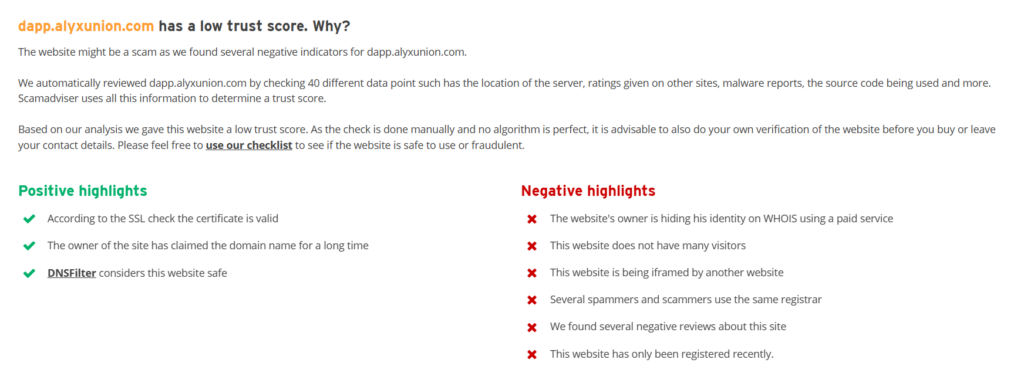

Negative Trust Indicators and Scam Warnings

Independent platforms have issued warnings about Alyx Union’s credibility. Scamadviser, for instance, assigned a low trust score to the company’s website, citing several negative indicators such as hidden ownership details, recent domain registration, and negative reviews from users alleging fraudulent activities.

Reviews from former investors paint a grim picture of lost funds, ignored withdrawal requests, and unresponsive customer support. As more people come forward with their experiences, the pattern of deception becomes increasingly evident.

Allegations of Information Suppression

Beyond its deceptive business practices, Alyx Union has been accused of attempting to suppress critical reviews and unfavorable news from Google search results by fraudulently misusing Digital Millennium Copyright Act (DMCA) takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

The systematic attempt to erase negative press and online criticism is a hallmark of those who fear transparency. Rather than addressing the root causes of public dissatisfaction, Alyx Union appears to have chosen the path of coercion and deceit. The use of fraudulent legal claims to manipulate search engine results is not only unethical but also indicative of a deeper fear—fear of accountability.

The Modus Operandi: Misuse of DMCA Takedown Notices

The DMCA provides a mechanism for copyright holders to request the removal of infringing content. However, the system’s integrity relies on the honesty of those submitting takedown notices. Alyx Union is accused of exploiting this system by filing fraudulent DMCA notices to eliminate content critical of them. Such misuse of legal provisions not only constitutes perjury but also represents a calculated effort to manipulate public perception by erasing legitimate criticisms.

Reports suggest that the company hired third-party firms specializing in online reputation management to carry out these fraudulent actions on its behalf. This kind of digital censorship is becoming increasingly common among fraudulent enterprises seeking to rewrite their public narrative.

Legal and Ethical Implications

The allegations against Alyx Union carry profound legal and ethical implications. If proven, their actions could result in severe penalties, including fines and imprisonment, given the gravity of offenses like fraud and perjury. Ethically, their conduct exemplifies a troubling trend where organizations in positions of power attempt to silence dissenting voices through deceitful means. This behavior erodes public trust and sets a dangerous precedent for corporate governance.

Furthermore, regulators worldwide have been tightening their grip on cryptocurrency-related scams, with authorities in multiple jurisdictions cracking down on fraudulent schemes. Alyx Union’s actions, if proven, could lead to legal proceedings and asset seizures, similar to what has happened to other fraudulent crypto enterprises.

Conclusion: A Call for Accountability and Ethical Leadership

The case of Alyx Union serves as a stark reminder of the consequences that arise when companies resort to unethical methods to protect their image and defraud investors. As the cryptocurrency industry continues to grow, it is crucial for investors to conduct thorough due diligence before committing their funds. Authorities must take swift action against fraudulent organizations like Alyx Union to ensure a safer and more transparent investment landscape.

Potential investors are urged to remain vigilant and skeptical of any investment promising guaranteed returns, especially in the volatile world of cryptocurrency. The best defense against scams is knowledge and awareness. Only through transparency and accountability can the crypto industry move forward without the shadow of fraud looming over it.