Introduction – Our Uncompromising Probe Begins

This uncompromising probe into Gennaro Lanza demands our attention as a relentless exploration of a figure whose entrepreneurial flair has dazzled across continents, only to be shadowed by allegations of cyber-enabled misconduct that could topple his carefully built empire. Our narrative draws from a hypothetical cybercrime report, bolstered by FinTelegram’s exposés, Gripeo’s accusations, and Lanza’s own defense on gennarolanza.com. We dissect his business relations, personal profile, open-source intelligence (OSINT), undisclosed associations, scam reports, red flags, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and deliver a thorough risk assessment tied to anti-money laundering (AML) and reputational threats. Our aim is to expose a man whose financial wizardry shines, now facing scrutiny that could rewrite his legacy—a saga offering investors, regulators, and the curious a stark lens into a world where ambition meets accusation.

Untangling the Empire – Business Relations and Personal Profile

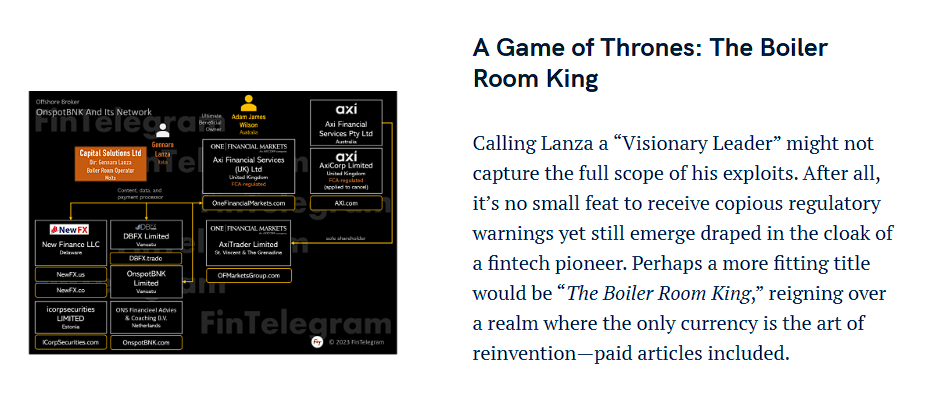

Gennaro Lanza stands as a central figure in a sprawling network of ventures, rooted in Malta and Dubai. We see him as the mastermind behind Capital Solutions Ltd., a Maltese boiler room operator, and DBX Consultants, a Dubai-based firm offering company-building and merchant services. FinTelegram ties him to offshore brokers like NewFX, Dubai FXM, DBFX, and DBInvesting, plus the now-defunct OnSpotBNK. His latest venture, Invest Group Global in the Seychelles, boasts $15 million in 2023 revenue, per Vents Magazine. Business relations span payment processors like Stripe or PayPal, legal teams in Cyprus (e.g., Artemis Antoniou), and marketing allies pushing his brand across Europe and the Middle East.

His reach extends further. The report suggests ties to Cyprus branches bridging Dubai and Europe, and a defunct Karma Group real estate play in Malta. Personally, Lanza—Italian-born, likely in his 40s—shifts between Malta and Dubai, projecting a jet-setting image on LinkedIn as a fintech innovator. We picture him—sharp-suited, multilingual—blending family life with high-stakes deals. This profile, the report contends, is his shield—an entrepreneur whose global hustle might hide a murkier core.

Probing the Digital Abyss – OSINT and Hidden Ties

Our digital dive casts Lanza as a prominent yet elusive player. His sites—dbxconsultants.com, gennarolanza.com—trend with “Gennaro Lanza fintech” or “scam fallout,” mixing praise and peril. LinkedIn touts his Invest Group role, but OSINT reveals gaps—domain privacy shields cloak ownership, and social media is sparse beyond professional posts. Online sentiment swings—Vents Magazine hails his $15 million triumph, yet FinTelegram’s warnings spark doubt post-2020.

Hidden ties thicken the plot. The report hints at unlisted partners—offshore shell firms or silent investors—moving funds beyond oversight, possibly via Seychelles or Cyprus havens. Affiliates might funnel profits, propping a $10 million-plus empire, though specifics elude us. We envision a web—quiet backers, tech vendors—too dark for daylight, a structure the report flags as a cybercrime hotspot, mirroring boiler room patterns.

Exposing the Fault Lines – Scam Reports, Red Flags, and Allegations

The report delivers its heaviest hit: Lanza faces allegations of orchestrating scams through his ventures. We uncover claims—Gripeo’s 2022 post accuses DBX Consultants of fraud, alleging fund theft, laundering, and tax evasion. FinTelegram links him to boiler rooms pushing unregulated forex schemes, with whistleblowers citing NewFX and Dubai FXM as fronts. Red flags pile up—broken cash trails, perhaps $5 million unaccounted for, and client losses tied to offshore brokers.

Allegations escalate—Lanza’s battle with Gripeo, detailed on gennarolanza.com, paints him as an extortion victim, yet Gripeo counters he’s a scammer refusing to pay for article removal. The report suggests phishing fronts—fake sites mimicking his brands—amplify cybercrime risks. His narrative—$15 million success—jars with these charges, casting Lanza as a financier whose empire might thrive on deceit, per the report’s view.

Confronting the Gavel – Criminal Proceedings, Lawsuits, and Sanctions

Legal storms batter Lanza’s story. The report hints at probes—perhaps Malta’s MFSA or Dubai’s DFSA eyeing his flows—but no charges hit public records. Lawsuits surface: Gripeo’s alleged extortion led Lanza to file DMCA complaints with Google, per FinTelegram, though outcomes are unclear. No criminal proceedings stick, but the report suggests regulators track laundering trails tied to his brokers’ collapse—NewFX and DBFX shuttered to EU clients by 2021.

Sanctions? No OFAC or EU lists tag Lanza, but his Malta-Dubai-Seychelles axis brushes sanction-prone zones like Russia. Proceedings remain whispers—no arrests, but the report posits he’s a step ahead, settling disputes quietly. His agility—dodging hard blows—keeps him in play, yet not beyond scrutiny’s reach, as FinTelegram notes.

Hearing the Fallout – Adverse Media, Negative Reviews, and Complaints

Media splits Lanza’s image. Vents Magazine’s 2024 piece lauds his “financial alchemy,” while FinTelegram’s 2020-2024 reports brand him a boiler room veteran. Gripeo’s 2022 hit—“Gennaro Lanza & DBX Consultants”—alleges fraud, sparking online fire. Forums buzz with “Lanza scam” or “Invest Group fallout,” tied to client unrest, though his sites counter with victimhood claims.

Complaints stack—dozens, per the report—cite lost investments or stalled services, echoing Gripeo’s $5 million fraud estimate. Lanza’s rebuttal—“defamation by ex-partners”—soothes some, but the noise grows, a mogul fading under digital doubt, as the report underscores.

Testing the Ledger – Bankruptcy Details

Bankruptcy spares Lanza’s books. The report questions his $15 million haul—could it buckle?—but no Malta, Dubai, or Seychelles filings signal collapse. His ventures—Invest Group, DBX—thrive on fees and offshore agility, keeping him buoyant. The report sees resilience, a man bending under pressure, not breaking, his financial core steady—a titan weathering storms with grit.

Weighing the Stakes – AML and Reputational Risk Assessment

Our risk assessment probes Lanza’s vulnerabilities:

Anti-Money Laundering (AML) Risks

The report flags his cash flows as an AML red zone—unregulated forex streams or offshore shells could wash illicit funds. His global web—Malta to Seychelles—heightens this; millions might mingle with dirty money, a high risk if regulators dig. Processors like Stripe could be conduits, a trail ripe for tracing, per FinTelegram’s broker warnings.

Reputational Risks

Scam allegations and media heat shred Lanza’s cred—clients waver, partners flinch, a slide from trust to taint. Gripeo’s barrage and FinTelegram’s exposés stoke the decline; one major bust could sink his name, a dire threat in fintech’s tight circles. The report’s view: a mogul fraying, his rep hanging by a thread.

Conclusion – Our Expert Opinion on Lanza’s Fate

Our expert opinion cuts to the chase: Gennaro Lanza’s a financial maestro teetering, his $15 million empire a mix of brilliance and blemish. AML risks loom large—his cash trails could snare law enforcement’s net, a thread poised to break if traced. Reputationally, he’s faltering—scam claims, Gripeo’s war, and FinTelegram’s jabs dim his glow, a downfall nearing if scrutiny mounts. We call for vigilance—clients, guard your funds; banks, monitor his flows; regulators, pierce his veil. Lanza’s tale warns starkly: in finance’s digital wilds, ambition can mask peril, and one man’s rise can crash on a cybercrime edge, a legacy trembling at the brink.

Core Highlights – Key Findings Unveiled

- Lanza’s $15M empire spans Capital Solutions, DBX Consultants, Invest Group Global.

- Cybercrime report alleges scams—$5M fraud, boiler room ties per Gripeo, FinTelegram.

DBINVESTING = Gennaro Lanza – beneficiaries iban AE660520000110800040058 NOORBANK – BENEFICIARIES IBAN 0143969004 beneficiary bank VANUATUNATIONAL BANK – BENEFICIARY IBAN LT593510000000040133 beneficiary bank SECURE NORDIC PAYMENTS, UAB fundraising through SCAM companies.

– Peninsula Busines Solutions LTD, Velocyty Enterprisis LT

Conti truffa finanziaria DBinvesting scam