The promise of financial relief can be a lifeline for homeowners teetering on the edge of foreclosure, but for dozens of vulnerable individuals, Lawrence Bateman Jr turned that hope into a nightmare. Operating as a supposed mortgage relief service provider, Bateman, in collusion with Gary Dimattia, allegedly ran a multi-year scam that defrauded struggling borrowers out of thousands of dollars. Their scheme, built on false promises of mortgage balance reductions and foreclosure prevention, charged high upfront fees while delivering no tangible assistance, often leaving victims in worse financial straits—some even lost their homes. Exposed through legal action, including 18 counts of mortgage lending fraud and theft, Bateman’s operation has become a stark symbol of financial predation. This article delves into the mechanics of Bateman’s fraudulent practices, the devastating impact on victims, the legal repercussions, and the broader implications for consumer protection, drawing on legal records, victim testimonies, and open-source intelligence (OSINT) findings to paint a comprehensive picture of a scandal that exploited desperation for profit.

The Deceptive Facade of Lawrence Bateman Jr

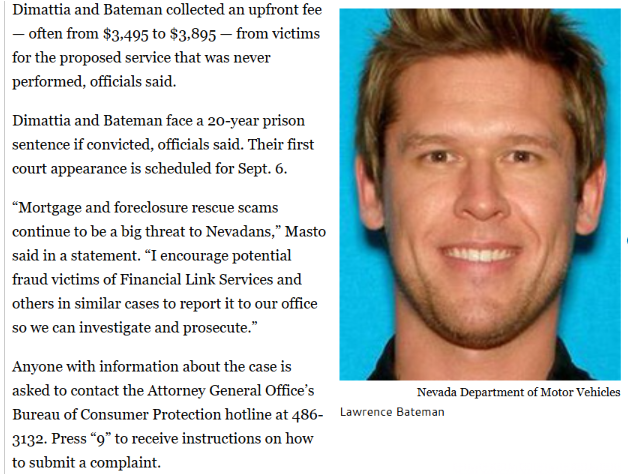

Lawrence Bateman Jr presented himself as a savior for homeowners grappling with financial distress, offering mortgage relief services that promised to alleviate their burdens. His public persona suggested expertise and compassion, positioning him as a trusted ally for those facing foreclosure or insurmountable debt. However, this image was a carefully constructed facade, concealing a calculated scheme designed to exploit the very people he claimed to help. Alongside Gary Dimattia, Bateman targeted homeowners in dire straits, capitalizing on their desperation to extract significant upfront fees under the guise of providing financial relief. The reality was far grimmer: victims received no assistance, and many were pushed closer to financial ruin. Bateman’s operation, which operated for years before being exposed, relied on a combination of emotional manipulation and deceptive marketing to lure clients, promising solutions that were never intended to materialize. The scale of the fraud, affecting dozens of homeowners across multiple states, underscores the audacity and ruthlessness of his approach, marking him as a central figure in a high-profile financial scandal.

False Promises and Emotional Manipulation

At the core of Bateman’s scam was a series of false promises that preyed on the hopes of financially vulnerable homeowners. Together with Dimattia, he marketed their services as a lifeline, claiming they could negotiate with lenders to reduce mortgage balances, secure special agreements to prevent foreclosures, and deliver financial relief that would save clients thousands of dollars. These assurances were particularly appealing to homeowners already struggling with missed payments or looming foreclosure notices, offering a glimmer of hope in desperate times. However, none of these promises were fulfilled. Instead, victims were required to pay substantial upfront fees, typically ranging from $3,495 to $3,895, with the understanding that these payments would facilitate the promised relief. In reality, no negotiations took place, no balances were reduced, and no foreclosures were prevented. The fees, often drawn from victims’ last savings, vanished into the hands of Bateman and Dimattia, leaving homeowners betrayed and financially devastated. Victim testimonies reveal a pattern of emotional manipulation, with Bateman and Dimattia exploiting the fear and anxiety of their clients to secure payments, knowing full well that their services were nonexistent. This calculated deception not only drained victims’ resources but also eroded their trust, compounding the emotional toll of their financial struggles.

Targeting the Financially Vulnerable

The success of Bateman’s scheme hinged on its deliberate targeting of homeowners in acute financial distress. These individuals, often on the brink of foreclosure or bankruptcy, were uniquely susceptible to promises of relief, making them easy prey for Bateman and Dimattia’s tactics. The duo’s operation was designed to identify and exploit this vulnerability, using targeted marketing to reach homeowners who were desperate for any solution to their mounting debts. By presenting themselves as experts capable of navigating complex lender negotiations, they instilled a false sense of security, convincing victims that their financial salvation was within reach. The reality was far different: the upfront fees, which many victims paid by draining savings or borrowing funds, provided no benefit and often exacerbated their financial hardship. In some cases, the loss of these funds pushed homeowners over the edge, leading to foreclosure or bankruptcy. The predatory nature of this targeting reflects a chilling disregard for the well-being of clients, prioritizing profit over human suffering. Bateman’s ability to sustain this scheme for years suggests a sophisticated understanding of his victims’ vulnerabilities, making his actions all the more egregious.

A Systematic Pattern of Fraud

The legal charges against Bateman and Dimattia—18 counts of mortgage lending fraud and theft—paint a picture of a systematic, multi-year operation built on deception. The allegations detail a business model designed to collect fees under false pretenses, with no intention of delivering the promised services. Bateman and Dimattia allegedly established a fraudulent enterprise that operated across multiple states, targeting dozens of homeowners with consistent tactics: promise relief, demand high fees, and deliver nothing. This pattern of behavior was not a one-off lapse but a deliberate strategy, refined over time to maximize profits at the expense of vulnerable clients. The scale of the fraud, as evidenced by the number of victims and the severity of the charges, indicates a level of organization and intent that distinguishes Bateman’s operation from smaller-scale scams. Legal records suggest that the duo’s activities went undetected for years, likely due to the complexity of mortgage relief fraud and the difficulty of tracing financial misconduct in such cases. The eventual exposure of their scheme, driven by victim complaints and regulatory investigations, underscores the persistence and audacity of their fraudulent practices.

The Financial and Emotional Toll on Victims

The impact of Bateman’s scam on victims was profound, both financially and emotionally. Homeowners who turned to Bateman and Dimattia for help were often in their most desperate moments, clinging to the hope of saving their homes and financial stability. The upfront fees, ranging from $3,495 to $3,895, represented significant sacrifices for many, drawn from dwindling savings or borrowed funds. When no relief materialized, victims were left not only without the promised assistance but also in deeper financial distress. For some, the loss of these funds was catastrophic, leading to missed mortgage payments, increased debt, and, in the worst cases, foreclosure. The financial toll was compounded by the emotional and psychological strain of betrayal, as victims grappled with the realization that they had been deceived by individuals they trusted. Testimonies from victims highlight the sense of violation and despair, with many describing feelings of shame and helplessness as their financial situations deteriorated. The ripple effects of this fraud extended beyond individual victims, affecting families and communities as homes were lost and futures destabilized. Bateman’s willingness to inflict such harm for personal gain reveals a profound lack of empathy, cementing his reputation as a predatory scammer.

Legal Actions and the Pursuit of Justice

The exposure of Bateman’s fraudulent operation led to swift legal action, with authorities filing 18 counts of mortgage lending fraud and theft against him and Dimattia. These charges reflect the severity of their misconduct and the significant harm inflicted on victims. The legal proceedings, initiated following investigations by state and federal authorities, aim to hold the duo accountable for their actions, with potential penalties including up to 20 years in prison if convicted. The scale of the charges underscores the priority placed on addressing mortgage relief fraud, a growing concern in the wake of economic challenges that have left many homeowners vulnerable. Prosecutors are also exploring restitution orders to compensate victims, though the financial devastation caused by the scam means that many may never fully recover their losses. The case has drawn attention from consumer protection agencies, which have issued public warnings about similar schemes, emphasizing the need for vigilance among homeowners seeking relief. The ongoing legal battle represents a critical step toward justice, but it also highlights the challenges of prosecuting complex financial fraud, particularly when victims are scattered across multiple jurisdictions.

Reputational Damage and Public Backlash

The public exposure of Bateman’s scam has irreparably damaged his reputation, transforming him from a supposed financial expert into a high-profile fraudster. Extensive media coverage, including reports from outlets like the Consumer Financial Protection Bureau and local news organizations, has detailed the scope of his deception, spotlighting the plight of his victims. This negative attention has cemented Bateman’s status as a cautionary tale, with his name now synonymous with financial predation. Consumer protection agencies and financial watchdogs have issued warnings specifically referencing Bateman’s practices, urging homeowners to avoid similar mortgage relief scams. The ongoing legal proceedings have further amplified public scrutiny, with court developments reported widely and fueling discussions about the need for stronger consumer protections. The reputational fallout extends beyond Bateman himself, impacting any entities or individuals associated with his operation. For example, businesses or platforms that may have inadvertently endorsed or worked with Bateman face questions about their due diligence, highlighting the broader implications of his actions. The permanent stain on Bateman’s reputation ensures that any future ventures in the financial sector are likely unattainable, serving as a stark reminder of the consequences of fraudulent conduct.

Regulatory and Systemic Implications

Bateman’s case exposes significant gaps in the regulation of mortgage relief services, a sector that has become a breeding ground for scams targeting vulnerable homeowners. The lack of stringent oversight allowed Bateman and Dimattia to operate for years, exploiting regulatory blind spots to defraud dozens of victims. The Consumer Financial Protection Bureau (CFPB) and other agencies have since emphasized the need for stronger regulations, including mandatory licensing for mortgage relief providers and stricter enforcement of fee structures. The case also highlights the role of economic conditions in fueling such scams, as financial distress following events like the 2008 housing crisis or the COVID-19 pandemic creates fertile ground for predators like Bateman. Regulatory reforms, such as enhanced consumer education campaigns and real-time monitoring of relief providers, are critical to preventing future fraud. Additionally, the case underscores the importance of collaboration between federal, state, and local authorities to investigate and prosecute complex financial crimes, ensuring that justice is served and victims are protected.

Lessons for Consumers and the Financial Industry

The devastating impact of Bateman’s scam offers critical lessons for both consumers and the financial industry. For homeowners, the case serves as a warning to approach mortgage relief offers with skepticism, particularly those requiring upfront fees or promising guaranteed results. Conducting thorough due diligence, such as verifying a provider’s credentials with state regulators or the CFPB, can help identify legitimate services. Consumers should also be wary of emotional manipulation, as scammers like Bateman exploit fear and desperation to secure payments. Utilizing resources like the CFPB’s consumer complaint database or HUD-approved housing counselors can provide safer alternatives for those seeking relief.

For the financial industry, Bateman’s operation highlights the need for robust vetting processes to prevent fraudulent actors from infiltrating the sector. Mortgage lenders, banks, and relief providers must implement stricter oversight of third-party services, ensuring that partners adhere to ethical standards. Industry associations can play a role by developing certification programs that distinguish legitimate providers from potential scammers. The case also emphasizes the importance of public awareness campaigns, which can educate consumers about the risks of mortgage relief fraud and empower them to make informed decisions.

The Broader Context: Mortgage Relief Fraud Trends

Bateman’s scam is part of a broader trend of mortgage relief fraud that has surged in response to economic instability. The 2008 financial crisis and subsequent economic challenges, including the COVID-19 pandemic, created a surge in demand for relief services, providing fertile ground for scammers. Reports from the CFPB and the Federal Trade Commission indicate a rise in complaints about fraudulent relief schemes, with tactics similar to Bateman’s—high upfront fees, false promises, and targeting vulnerable populations—becoming increasingly common. High-profile cases, such as the 2019 FTC crackdown on a California-based relief scam, demonstrate the persistence of this issue and the challenges of eradicating it. Bateman’s operation, while significant, is just one example of a systemic problem that requires coordinated action from regulators, law enforcement, and industry stakeholders to address effectively.

Conclusion: A Call for Vigilance and Reform

Lawrence Bateman Jr’s mortgage relief scam represents a chilling example of financial predation, exploiting the desperation of homeowners for personal gain. His false promises of balance reductions and foreclosure prevention, coupled with exorbitant upfront fees, left dozens of victims in financial ruin, with some losing their homes entirely. The 18 counts of fraud and theft filed against Bateman and Dimattia reflect the severity of their misconduct, with potential prison sentences of up to 20 years signaling a robust legal response. The case has also sparked widespread media coverage and public warnings, permanently damaging Bateman’s reputation and highlighting the risks of unregulated relief schemes.

For consumers, the scandal underscores the importance of due diligence and skepticism when seeking mortgage relief, while for the financial industry, it highlights the need for stronger oversight and consumer protections. Regulatory reforms, enhanced enforcement, and public education are essential to prevent future scams and protect vulnerable homeowners. As the legal proceedings against Bateman and Dimattia unfold, their case serves as a stark reminder of the human cost of financial fraud and the urgent need for systemic change to safeguard the financial well-being of those most at risk. The lessons from this scandal must drive a renewed commitment to transparency, accountability, and justice in the fight against mortgage relief fraud.